Initiating Coverage | Luggage

February 21, 2018

Safari Industries

BUY

CMP

`532

On a fast paced ‘Safari’

Target Price

`650

Safari Industries Ltd (Safari ) is the third largest branded player in the Indian

Investment Period

12 Months

luggage industry. Post the management change in 2012, it has witnessed

complete restructuring in business and product portfolio. This restructuring has

helped it in posting a CAGR of 42% in revenue and 46% in PAT over 2012-17. It

Stock Info

has also now captured ~14% market share in a ~`2600 cr branded luggage

Sector

Luggages

market.

Market Cap (` cr)

1,184

Favourable Industry dynamics for organized players post GST: The Indian luggage

Net Debt (` cr)

39

industry is valued at `9000cr+ and is largely dominated by the unorganized

Beta

0.3

sector. The top three branded players namely- VIP Industries, Samsonite and Safari

forms only ~28% of this market. Owing to improving economy and travel, the

52 Week High / Low

664 / 205

luggage industry has posted a 13%+ CAGR in the past decade and is expected to

Avg. Daily Volume

12,609

maintain this momentum for next few years. With GST implementation in 2017,

Face Value (`)

2

the new cost dynamics has led to industry shifting towards organized players.

BSE Sensex

33,844

On a strong growth trajectory since 2012: Post the management change in 2012,

Safari has grown its revenue by 6x in the last 7 years. This has been achieved by

Nifty

10,397

foraying in many new categories like back pack, school bags ( via acquisition of

Reuters Code

SAFA.BO

Genius and Genie) and improvement in distribution networks. Also, it adopted

Bloomberg Code

SII.IN

product rationalization & strategy realignment where non performing SKUs were

eliminated. Currently, its product are available in major 25+ cities via

3,500+

outlets.

Margins have doubled and likely to stay at 9%+ level: Its margins have more than

Shareholding Pattern (%)

doubled from 4.1% in FY2014 to 9.1% in M9FY2018, driven by launch of new

Promoters

57.8

product categories and business restructuring. This was also led by better

MF / Banks / Indian Fls

21.2

negotiation with Chinese suppliers (with increasing scale of Safari’s operations)

and relatively stable ` exchange rate. We expect it to maintain 9%+ margins from

FII / NRIs / OCBs

6.0

FY2018 onwards led by regular price hikes, shift towards organised player and

Indian Public / Others

15.0

favourable industry dynamics.

Outlook and Valuation: We expect its revenue to grow by 23% CAGR over

Abs. (%)

3m 1yr

3yr

FY2017-20E on the back of growth in its recently introduced new products. We

Sensex

1.3

18.6

14.3

expect its earnings to grow by ~59% CAGR, owing to stable operating margins

Safari

(2.4)

155.0

247.0

and its asset light model. Safari currently trades at a P/E of 40x FY2019E and 30x its

FY2020E EPS which looks attractive looking at its strong brand play story emerging in the

luggage industry. We initiate coverage on the stock with a Buy recommendation and

Target Price of `650 (36x FY2020E EPS), indicating an upside of 18%.

3 year daily price chart

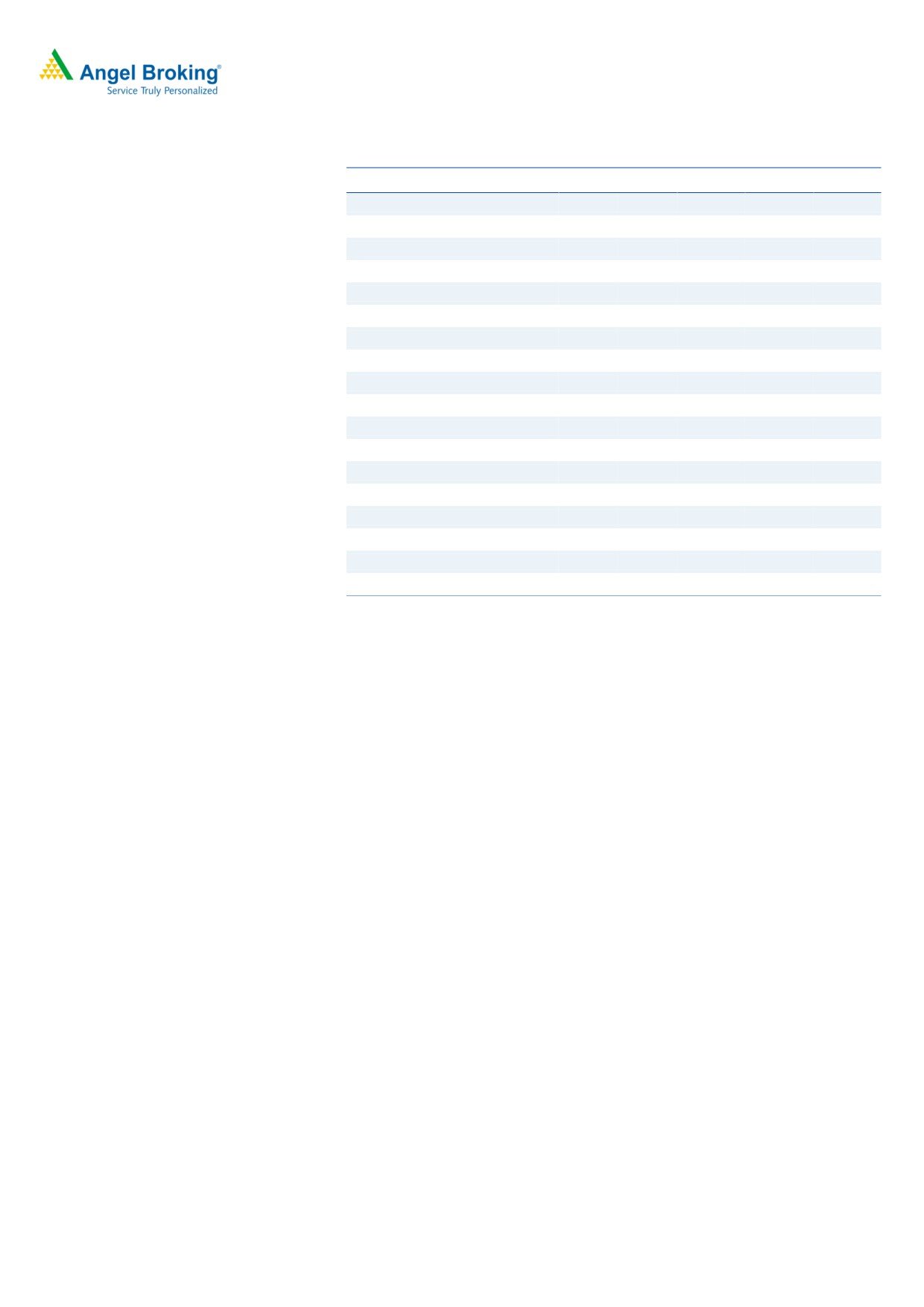

Key financials

700

Y/E March (Rs cr)

FY2016

FY2017E

FY2018E

FY2019E

FY2020E

600

Net Sales

278

359

409

532

665

500

% chg

28.8

29.0

14.0

30.0

25.0

400

300

Net Profit

7.8

10.4

20.4

29.3

40.0

200

% chg

55.9

33.8

96.2

43.6

36.4

100

OPM (%)

6.7

6.3

9.4

9.8

10.3

0

EPS (Rs)

3.5

4.7

9.2

13.2

18.0

P/E (x)

152.1

113.7

58.0

40.4

29.6

P/BV (x)

13.1

11.9

10.0

8.2

6.5

Source: Company, Angel Research

RoE (%)

8.5

10.4

17.2

20.1

21.9

RoCE (%)

9.7

12.1

19.6

23.5

26.3

EV/Sales (x)

4.4

3.4

3.0

2.3

1.8

Nidhi Agrawal

EV/EBITDA (x)

66.8

54.4

31.6

23.3

17.7

022-39357800 Ext: 6872

Source: Company, Angel Research, Note: CMP as of February 21, 2018

Please refer to important disclosures at the end of this report

1

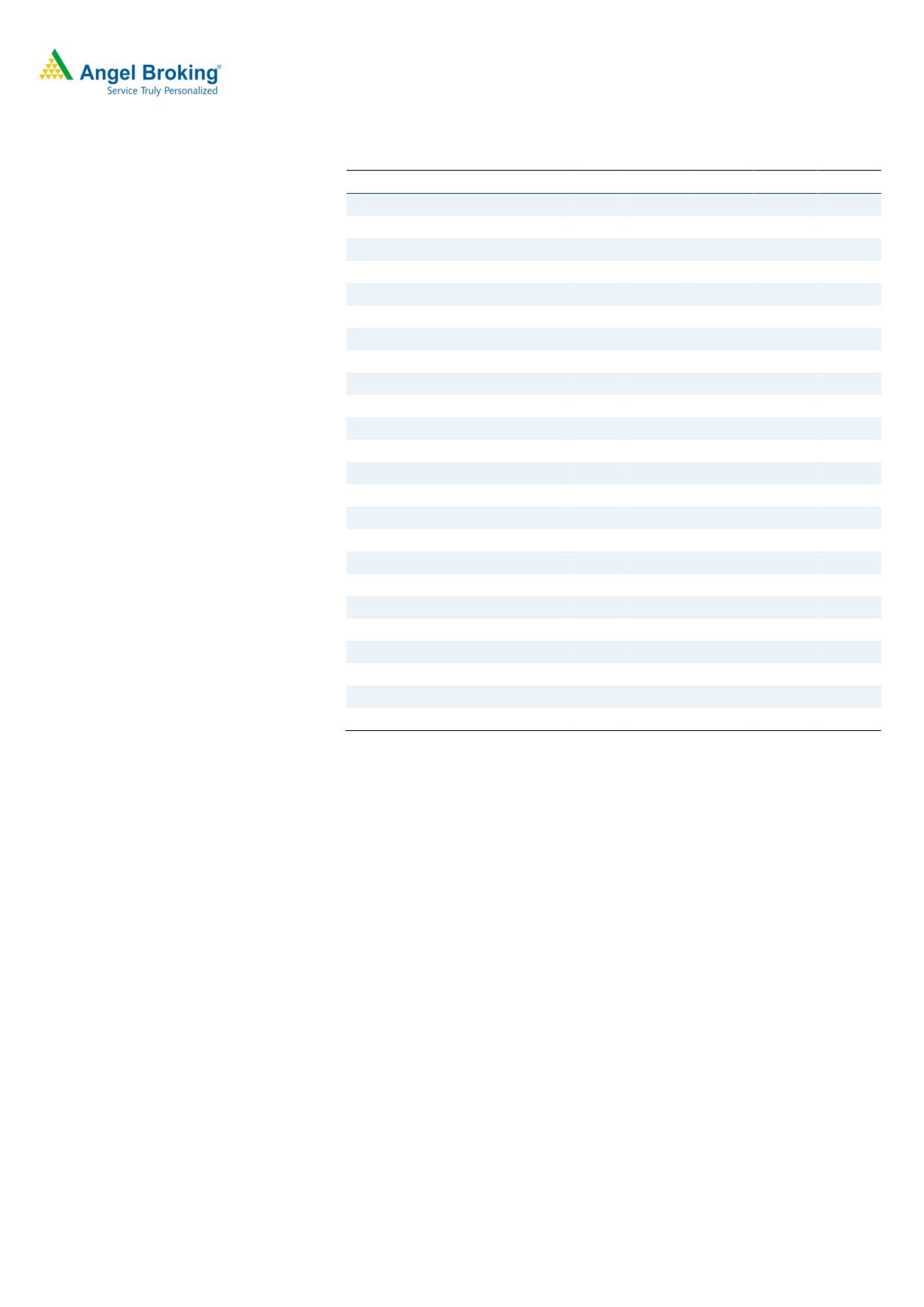

Initiating Coverage

Safari Industries

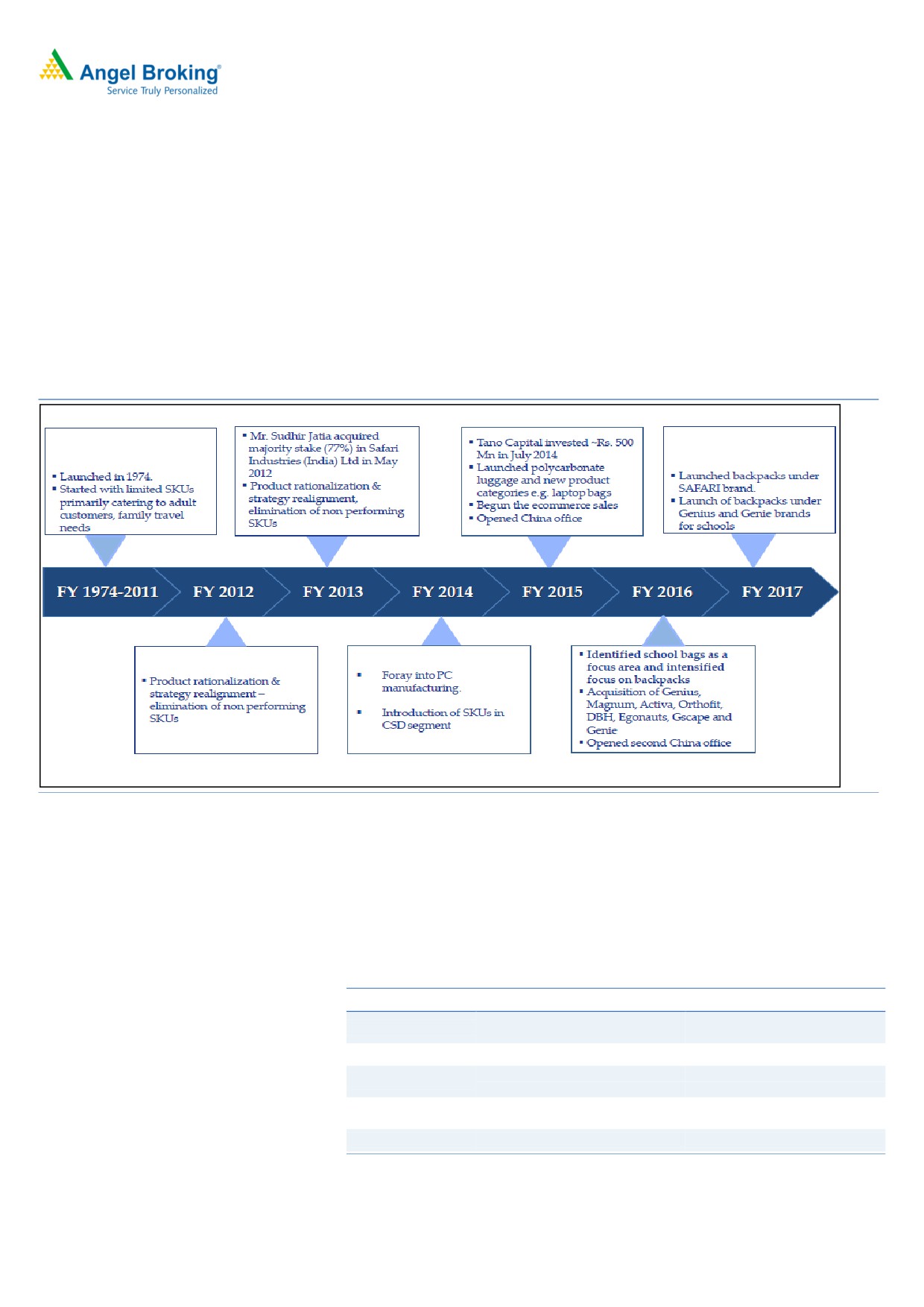

Company background

Safari is in the business of manufacturing and trading of luggage and luggage

accessories. Safari was incorporated in 1980 by Mr. Sumatichandra H Mehta and

it used to basically manufacture injection moulded plastic articles and vacuum

formed plastic articles, at its plants at Bombay and Halol, Gujarat. Mehta and

family. In 2012, the company was taken over by Mr Sudhir Jatia who was

previously working as MD with VIP industries. Since then there has been business

restructuring where lot of new products were introduced. The company largely

procures quality products from China and sell it under its brand Safari.

Exhibit 1: Company’s timeline

Source: Company

Product categories

There are two broad categories of luggage i.e hard luggage and soft luggage.

Hard luggages (20% of revenue) are mainly made of Poly Propylene (PP) and Poly

Carbonate (PC) and manufactured in-house by Safari at its plant located at Halol,

Gujarat. Soft luggages are made of fabrics of various kinds and are mainly

imported from China where the company has opened 2 offices for design and

procurement.

Exhibit 2: Product categories

Group

Soft Luggage

Hard Luggage

Rolling Duffle bags, Upright 2/ 4

Poly Carbonate & ABS,

Product Category

wheeler, Children bags, backpacks

PolyPropylene

Revenue Contribution 80%

20%

Branded offering in a largely

PolyPropylene-Steadily getting

Strategy

unorganized market

phased out

Poly Carbonate & ABS- Focus on

Innovating by adding features

innovative designs

Sourcing

Imported from China

Largely made in house

Source: Company, Angel Research

2

Initiating Coverage

Safari Industries

Investment Arguments

Shift in trend towards the organized sector to propel growth

1. Favourable Industry dynamics for organized players post GST

The Indian luggage industry is valued at `9000cr+ and is largely dominated by

the unorganized sector. The top three branded players namely- VIP Industries,

Samsonite and Safari forms only ~28% of this market. VIP Industries is the market

leader with over 50% market share whereas Samsonite has been losing market

share ( current at ~35% from the past level of 50%+). Backed by re infused energy

from new management, Safari has been grabbing market share in the last few

years and currently it stands at 14-15%.

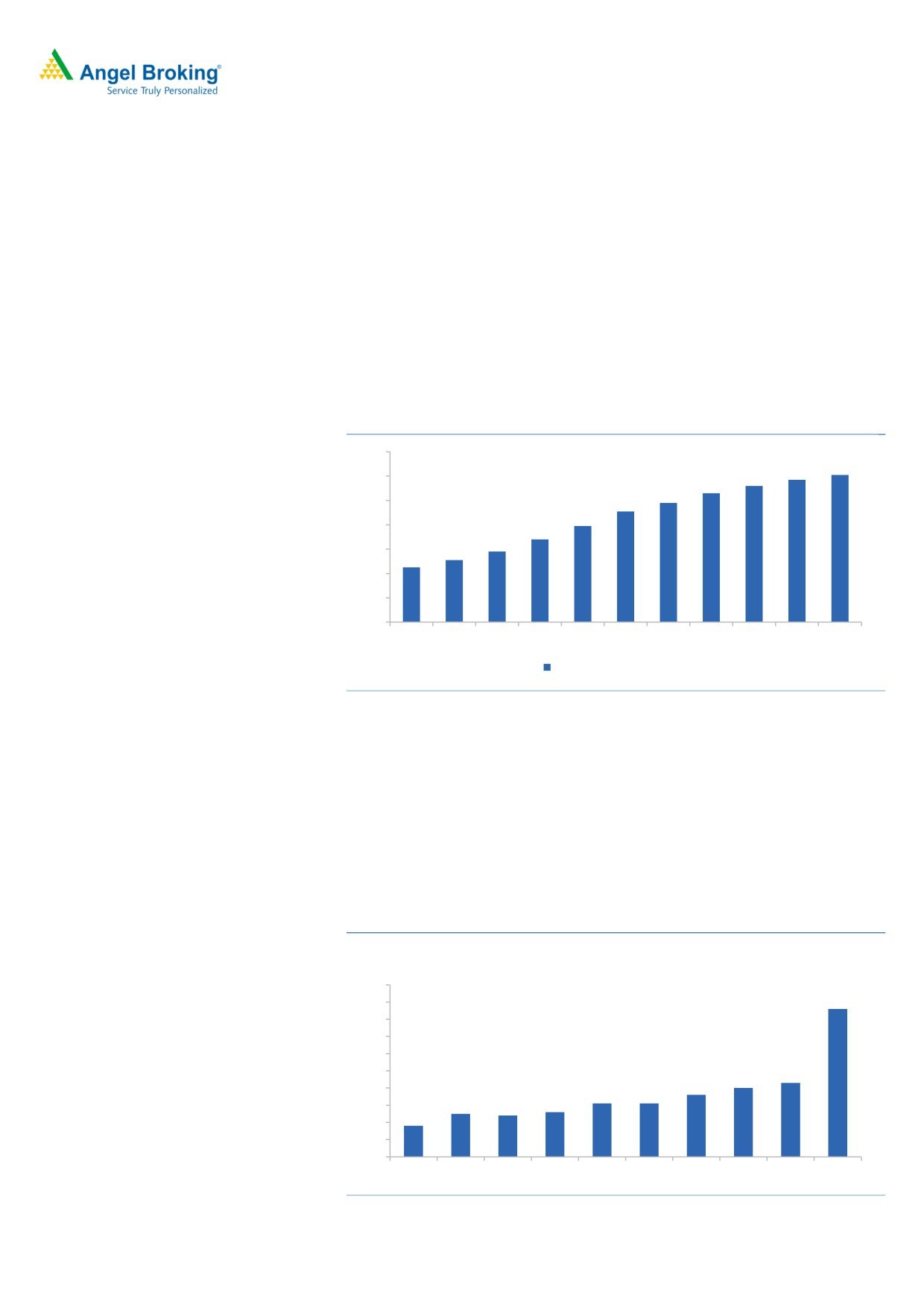

Exhibit 3: Luggage industry posted ~15% CAGR during 2011-16

140

120

100

80

60

40

20

0

FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21

Sales of Luggage (Rs Bn)

Source: Company, Angel research

2. Increasing travel and premiumization is driving the growth

Most players are coming up with more youth-orientated products like lightweight

and more efficient backpacks and duffel bags. Robust demand for luggage is led

by the fact that most youngsters now are keen on travel and adventure, increasing

demand for hands-free and hassle-free luggage. The Indian luggage industry is

likely to benefit as the people have become more demanding in term of style and

comfort for travel luggage.

Exhibit 4: Indian tourism industry growing >10% CAGR

Indian tourism industry (USD bn)

100

90

80

70

60

50

40

30

20

10

0

2006

2007

2008

2009

2010

2011

2012

2013

2015

2025E

Source: Company, Angel Research

3

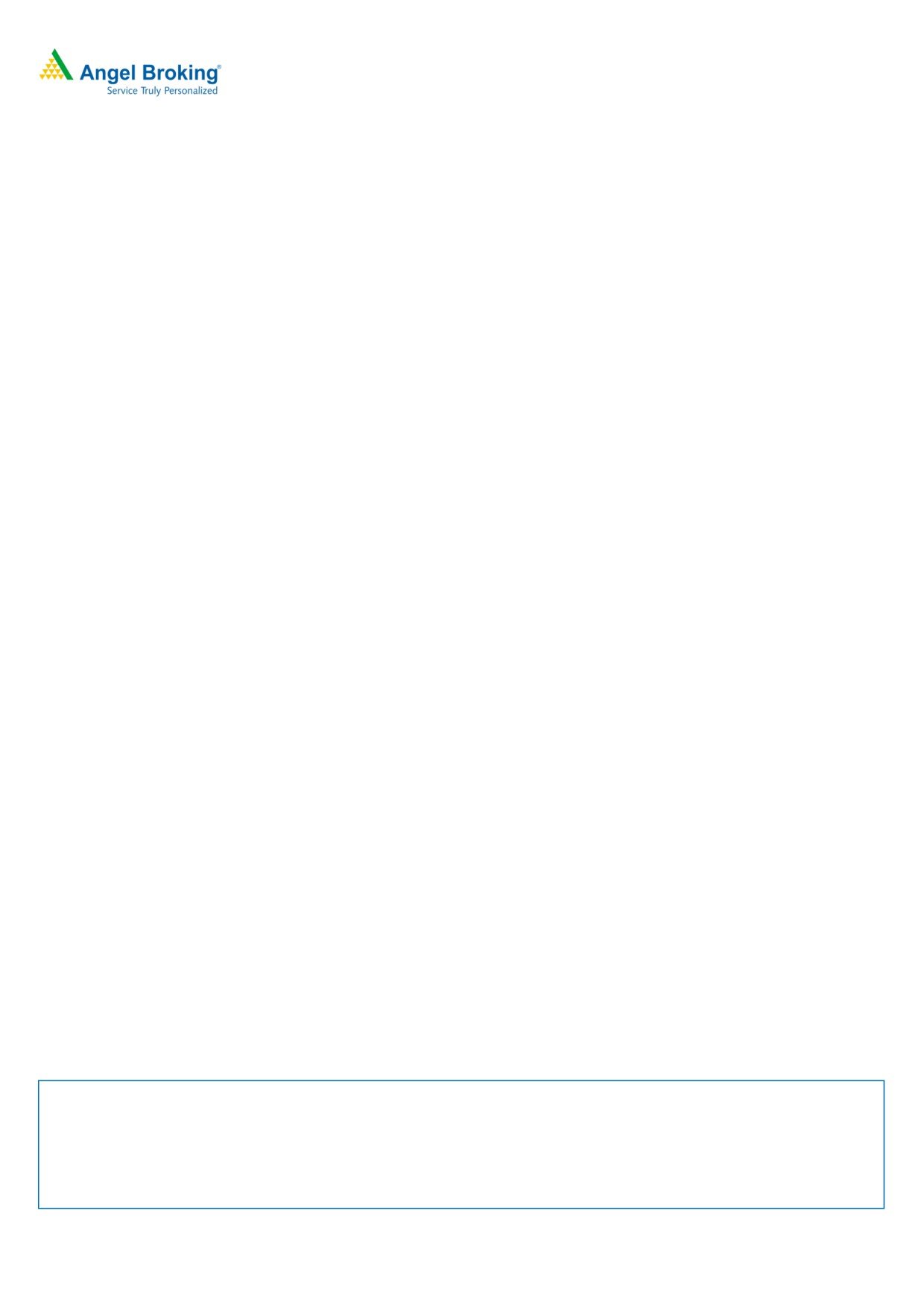

Initiating Coverage

Safari Industries

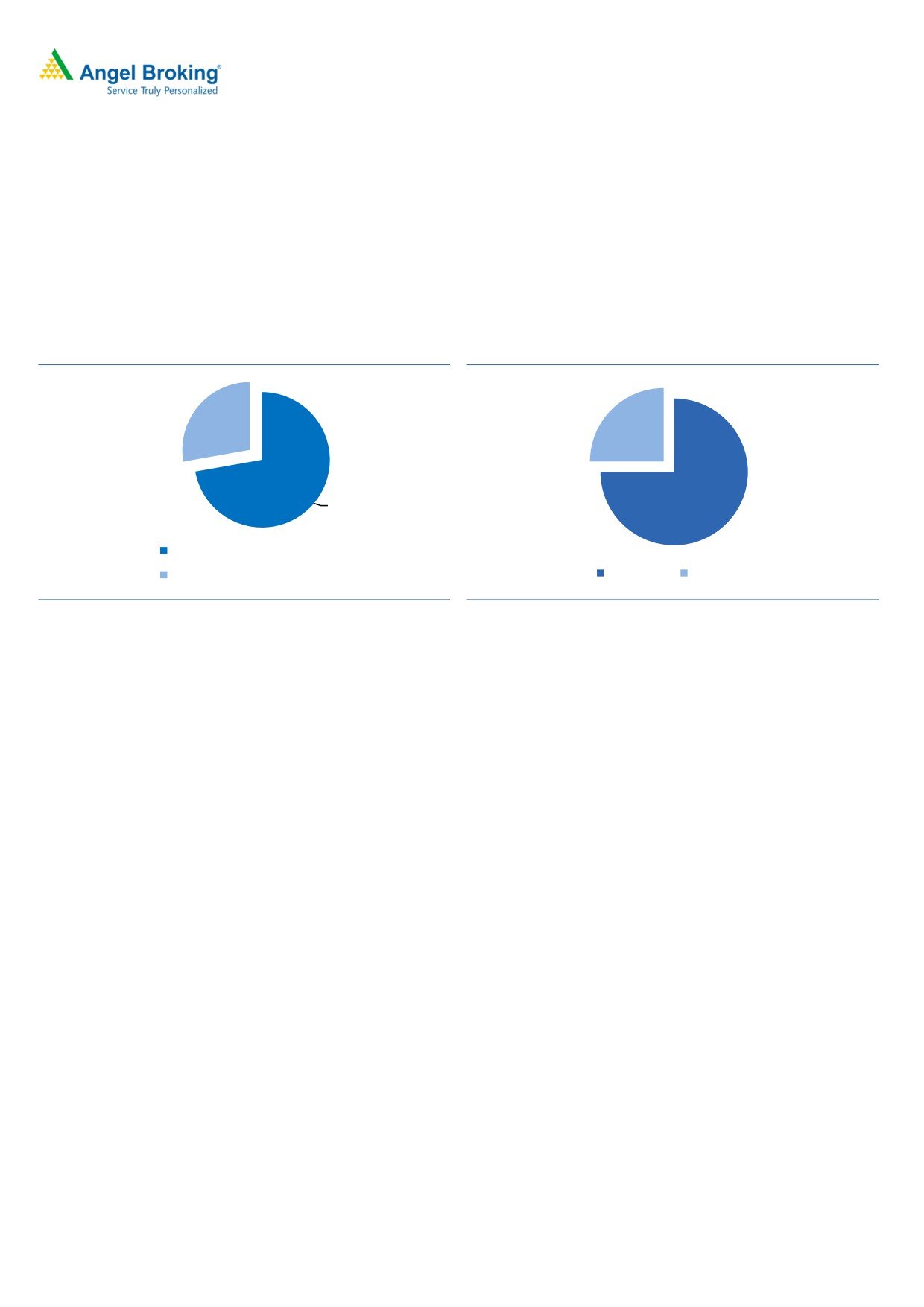

3. GST has further created level field for organised players

Owing to improving economy and consumer confidence, increasing travel and

product premiumization, the luggage industry has posted a 13%+ CAGR in the

past decade and is expected to maintain this momentum for next few years. With

GST implementation in 2017, the new cost dynamics has further led to industry

shifting towards organized players.

Exhibit 5: Organised v/s unorganised market share

Exhibit 6: Segment wise break-up

25%

28%

72%

75%

Market size of unorganised players

Top three players combined share

Soft Luggage

Hard Luggage

Source: Industry, Angel Research

Source: Industry, Angel Research

Company on a strong growth trajectory since 2012

In 2012, the company was taken over by Mr Sudhir Jatia who was previously MD

with VIP industries. Since then there has been business restructuring where lot of

new products were introduced and old non selling SKUs were discontinued. The

company now largely procures quality products ( specially in soft luggage) from

China and sell it under its brand Safari.

Post the management change, Safari has grown its revenue by 6x in the last 7

years. This has been achieved by foraying in many new categories like back pack,

school bags ( via acquisition of Genius and Genie in 2015) and improvement in

distribution networks.

Also, it adopted product rationalization & strategy realignment where non

performing SKUs were eliminated. Currently, its products are available in major

25+ cities via 3,500+ outlets.

4

Initiating Coverage

Safari Industries

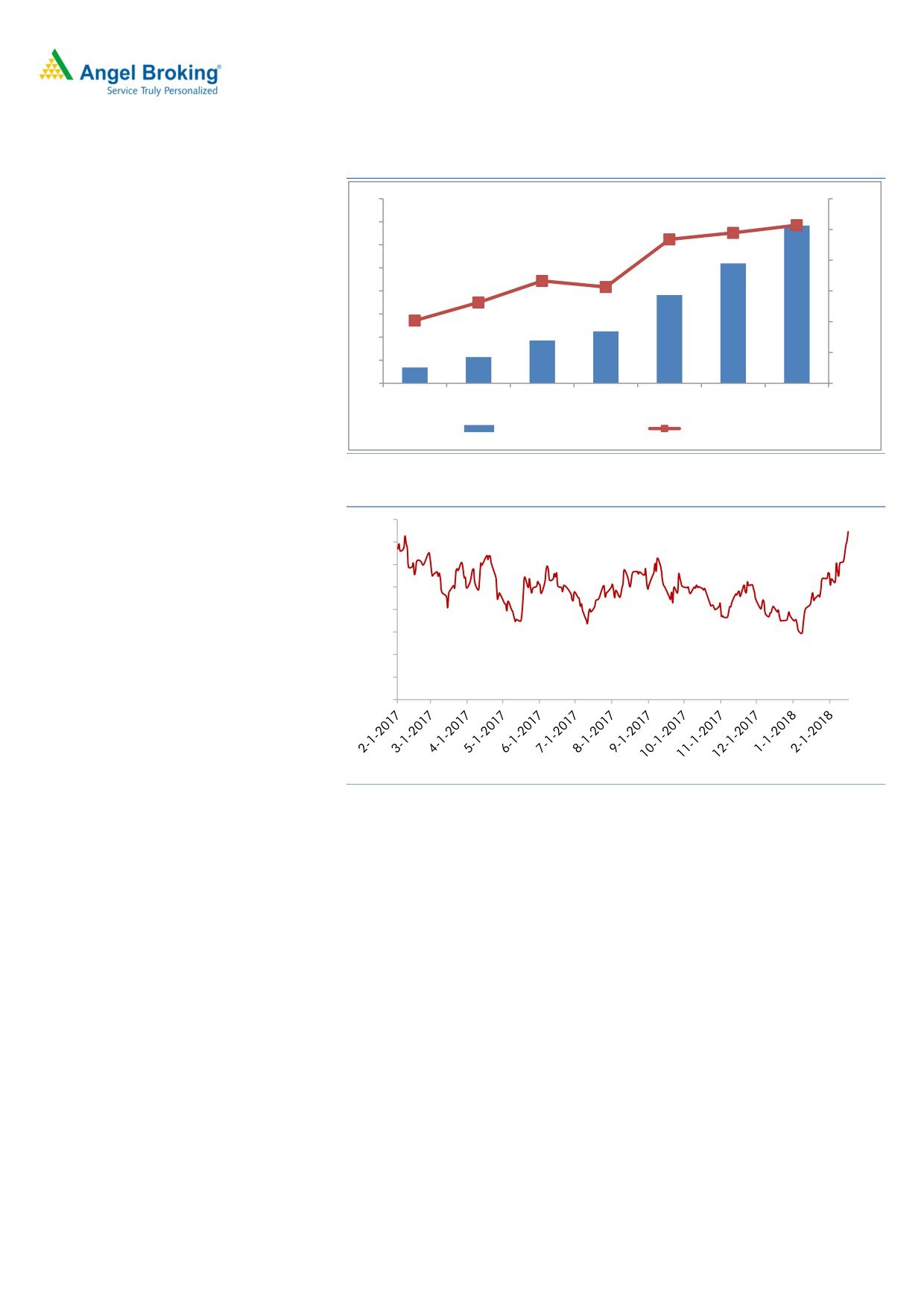

Exhibit 7: Revenues shown strong growth

600

100%

500

80%

400

60%

300

40%

200

20%

100

0

0%

FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19

Net Sales- Rs cr

% chg

Source: Company, Angel Research

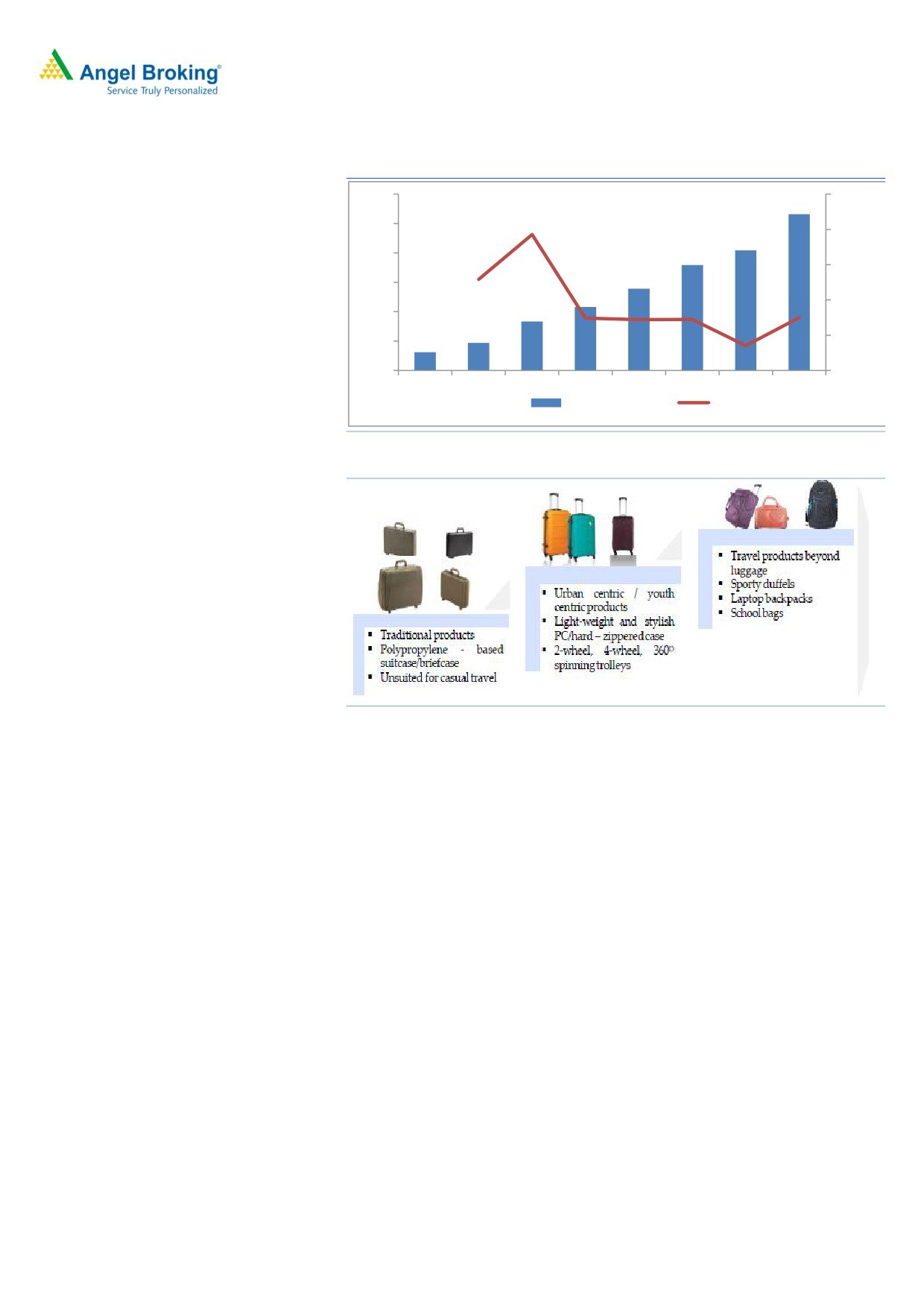

Exhibit 8: Revamped the product portfolio to suit the changing trends

Source: Company, Angel Research

Margins have doubled and likely to stay at 9%+ level

The company has more than doubled its margins from 4.1% in FY2014 to 9.1% in

M9FY2018, driven by launch of new product categories and product

premiumization. This was also led by better negotiation with Chinese suppliers

(with increasing scale of Safari’s operations) and relatively stable INR exchange

rate and depreciation of Chinese Yuan.

VIP’s 80% revenue comes from soft luggage, which is imported from China.

However, with closure of many luggage units in China (owing to pollution

concerns), the surviving suppliers have started taking price hikes which is likely to

put pressure on margins. We expect the company to largely post 9%+ margins

from FY2018 onwards led by regular price hikes, shift towards organised player

post GST and favourable industry dynamics.

5

Initiating Coverage

Safari Industries

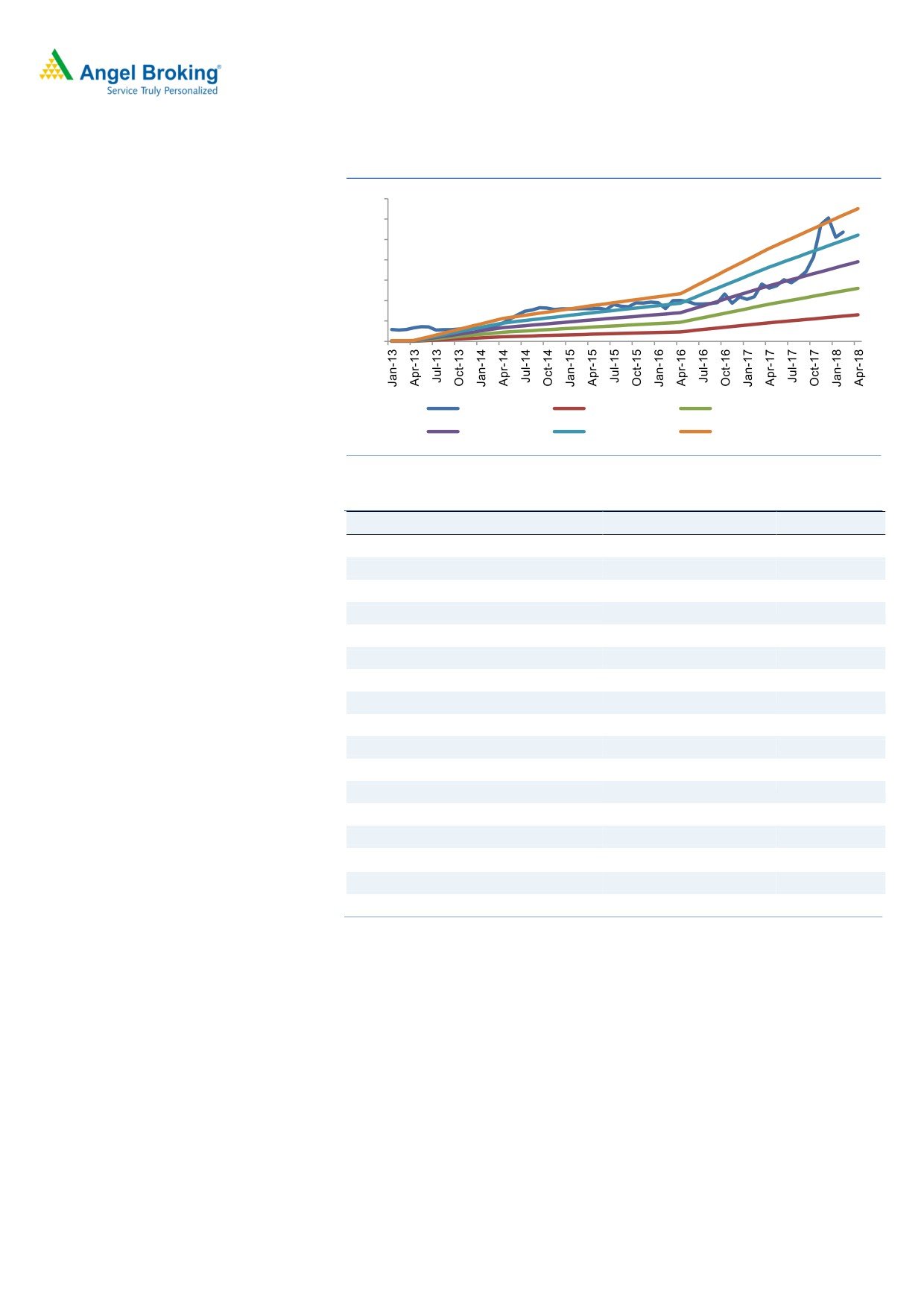

Exhibit 9: Improving margin profile

80

12.0%

70

10.0%

60

8.0%

50

40

6.0%

30

4.0%

20

2.0%

10

0

0.0%

FY14

FY15

FY16

FY17

FY18

FY19

FY20

Operating profit/ EBITDA

Operating margin

Source: Company, Angel Research

Exhibit 10: Yen is showing strength against rupee since January 2018

61

60

59

58

57

56

55

54

53

Source: Company, Angel Research

Outlook

Going ahead, we expect Safari to report a top-line CAGR of ~23% over FY207-

20E on the back of growth in its recently introduced new products and improving

distribution network. Further, GST implementation will also boost the volume of

branded sales. On the bottom-line front, we expect the company to report ~59%

CAGR over FY2017-20E on a small base, owing to stable operating margins and

product premiumization. The stock has turned 5x in last 4 years, however we feel

that the company with its aggressive track record and pricing strategy will continue

to post better growth than its peers like VIP and Samsonite although on a smaller

base.

Valuation

Safari currently trades at a P/E of 40x FY2019E and 30x its FY2020E EPS which

looks reasonable looking at its strong growth trajectory and its strong brand play

story emerging in the luggage industry. Its M9FY2018 results has shown a yearly

growth of 112% in net profits. We Initiate Coverage on the stock with a Buy

recommendation and Target Price of `650 (36x FY2020E EPS), indicating an

upside of ~18% from the current levels.

6

Initiating Coverage

Safari Industries

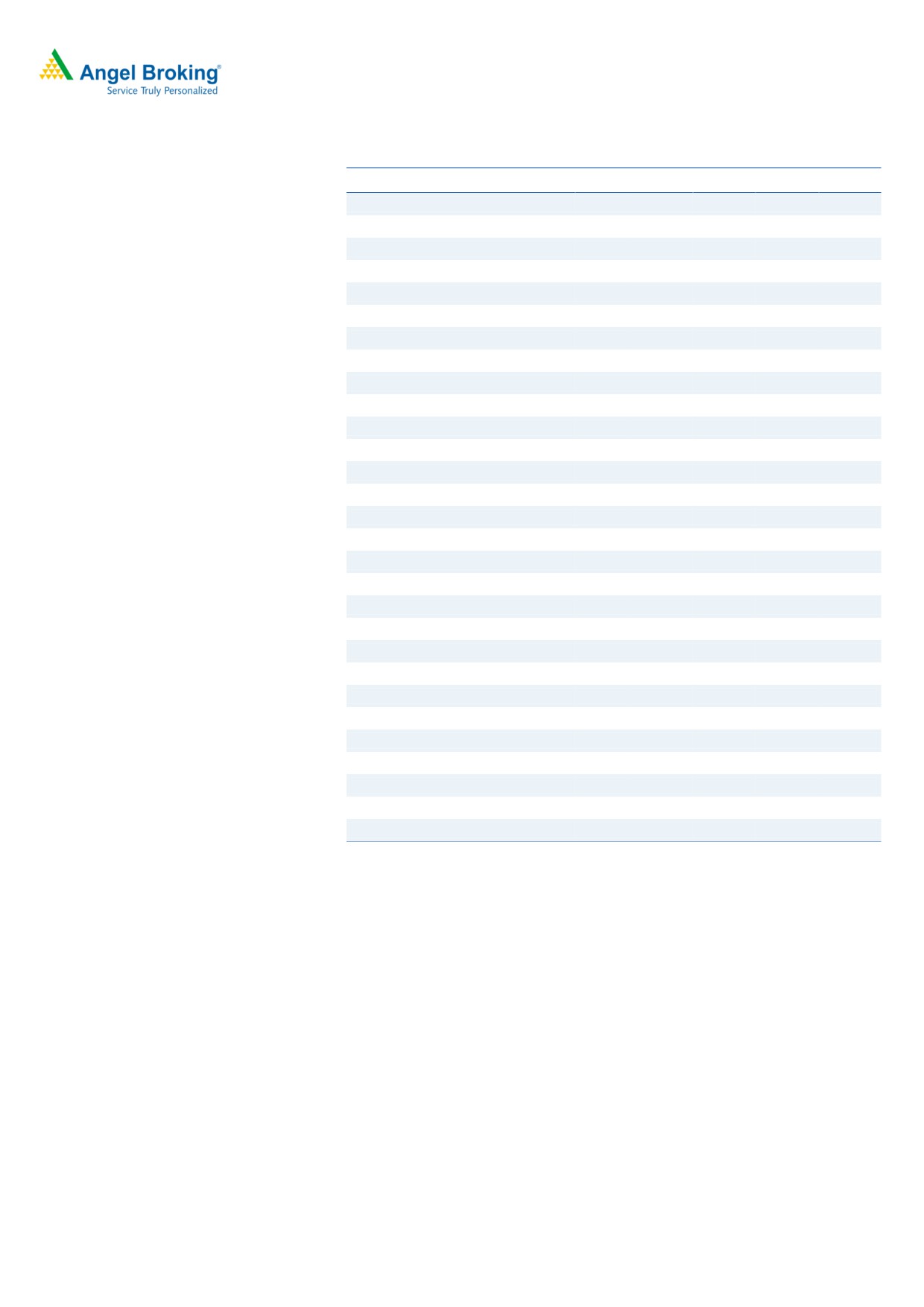

Exhibit 11: One year forward PE chart

700

600

500

400

300

200

100

0

Close -Unit Curr

10.0 X

20.0 X

30.0 X

40.0 X

50.0 X

Source: Company, Angel Research

Exhibit 12: Peer comparison

Comparison

VIP Industries

Safari

Market Cap (Rs cr)

4808

1230

SKU (units)

100+

35+

Network

8000+

3500+

CAGR % (FY14-17)

Revenue

9.4%

29.2%

PAT

21.9%

204.4%

Average OPM

8.8%

5.3%

Projections- FY2019

Revenue

1693

532

PAT

128

29

Valuations FY2019

EV/ EBITDA

23.4

24.2

P/E

39.4

40.4

Return%- FY2019

ROE

24.6%

20.1%

ROCE

35.1%

26.3%

Source: Company, Angel Research

Risks and concerns

Volatility in foreign currency could impact the company’s profitability (80% of

its revenue comes from soft luggage, which is imported from China).

With closure of many luggage units in China (owing to pollution concerns), the

surviving suppliers have started taking price hikes which could put pressure on

its margins, unless price hike is taken.

Increase in competition from unorganized players could impact overall growth

of the company

Safari’s 20% sales comes from hard luggage segment and any increase in

input cost (most of the key raw material is polypropylene and aluminum) could

negatively impact profitability

7

Initiating Coverage

Safari Industries

Profit & Loss Statement

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E

FY2020E

Total operating income

278

359

409

532

665

% chg

28.8

29.0

14.0

30.0

25.0

Total Expenditure

260

336

371

480

596

Raw Material

173

219

238

307

380

Personnel

29

41

47

61

77

Selling and Administration Expenses

48.1

65.4

73.6

95.7

119.6

Others Expenses

9

10

12

16

19

EBITDA

19

22

38

52

68

% chg

63.1

21.3

70.4

35.9

31.4

(% of Net Sales)

6.7

6.3

9.4

9.8

10.3

Depreciation& Amortisation

4

5

6

7

7

EBIT

14

17

32

45

61

% chg

70.7

20.0

86.3

40.8

34.7

(% of Net Sales)

5.2

4.8

7.9

8.5

9.2

Interest & other Charges

3

3

3

3

3

Other Income

1

1

1

2

2

(% of PBT)

6.5

7.4

4.3

3.6

3.2

Share in profit of Associates

-

-

-

-

-

Recurring PBT

12

15

30

44

60

% chg

105.9

25.2

103.9

43.6

36.4

Tax

4

5

10

14

20

(% of PBT)

35.2

34.1

33.0

33.0

33.0

PAT (reported)

8

10

20

29

40

Extraordinary Items

(0)

(1)

-

-

-

ADJ. PAT

8

10

20

29

40

% chg

55.9

33.8

96.2

43.6

36.4

(% of Net Sales)

2.8

2.9

5.0

5.5

6.0

Fully Diluted EPS (Rs)

3.5

4.7

9.2

13.2

18.0

% chg

55.9

33.8

96.2

43.6

36.4

Source: Company, Angel Research

8

Initiating Coverage

Safari Industries

Balance Sheet

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E FY2020E

SOURCES OF FUNDS

Equity Share Capital

4

4

4

4

4

Reserves& Surplus

87

96

115

141

178

Shareholders Funds

91

100

119

146

182

Equity Share Warrants

-

-

-

-

-

Total Loans

58

44

46

48

50

Deferred Tax Liability

-

-

-

-

-

Total Liabilities

149

143

165

194

233

APPLICATION OF FUNDS

Gross Block

42

45

50

55

60

Less: Acc. Depreciation

18

22

28

34

42

Net Block

24

23

22

21

19

Capital Work-in-Progress

-

1

1

1

1

Investments

-

-

-

-

-

Current Assets

143

165

197

240

295

Inventories

76

94

105

134

164

Sundry Debtors

54

58

64

77

93

Cash

5

5

19

18

25

Loans & Advances

8

7

8

11

13

Other Assets

-

-

-

-

-

Current liabilities

27

54

65

78

94

Net Current Assets

116

110

132

161

202

Deferred Tax Asset

(0)

(0)

(0)

(0)

(0)

Total Assets

149

143

165

194

233

Source: Company, Angel Research

9

Initiating Coverage

Safari Industries

Cashflow Statement

Y/E March (` cr)

FY2016

FY2017

FY2018E FY2019E FY2020E

Profit before tax

12

15

30

44

60

Depreciation

4

5

6

7

7

Change in Working Capital

0

0

(7)

(31)

(33)

Interest / Dividend (Net)

3

3

3

3

3

Direct taxes paid

(4)

(5)

(10)

(14)

(20)

Others

(28)

4

2

(1)

(1)

Cash Flow from Operations

(13)

22

25

7

17

(Inc.)/ Dec. in Fixed Assets

(16)

(5)

(5)

(5)

(5)

(Inc.)/ Dec. in Investments

1

(1)

0

0

0

Cash Flow from Investing

(15)

(6)

(5)

(5)

(5)

Issue of Equity

7

0

0

0

0

Inc./(Dec.) in loans

3

1

2

2

2

Dividend Paid (Incl. Tax)

0

(16)

(2)

(2)

(3)

Interest / Dividend (Net)

(3)

(3)

(3)

(3)

(3)

Cash Flow from Financing

29

(17)

(3)

(3)

(4)

Inc./(Dec.) in Cash

1

(2)

17

(1)

8

Opening Cash balances

3

4

2

19

18

Closing Cash balances

4

2

19

18

25

Source: Company, Angel Research

10

Initiating Coverage

Safari Industries

Key Ratios

Y/E March

FY2016

FY2017

FY2018E

FY2019E FY2020E

Valuation Ratio (x)

P/E (on FDEPS)

152.1

113.7

58.0

40.4

29.6

P/CEPS

101.0

79.6

45.2

33.3

25.3

P/BV

13.1

11.9

10.0

8.2

6.5

Dividend yield (%)

0.0

0.1

0.1

0.2

0.3

EV/Sales

4.4

3.4

3.0

2.3

1.8

EV/EBITDA

66.8

54.4

31.6

23.3

17.7

EV / Total Assets

8.3

8.5

7.3

6.3

5.2

Per Share Data (`)

EPS (Basic)

3.5

4.7

9.2

13.2

18.0

EPS (fully diluted)

3.5

4.7

9.2

13.2

18.0

Cash EPS

5.3

6.7

11.9

16.1

21.2

DPS

0.2

0.4

0.8

1.1

1.5

Book Value

40.9

44.9

53.5

65.5

82.0

Returns (%)

ROCE

9.7

12.1

19.6

23.5

26.3

Angel ROIC (Pre-tax)

10.0

12.5

22.2

25.8

29.5

ROE

8.5

10.4

17.2

20.1

21.9

Turnover ratios (x)

Asset Turnover (Gross Block)

6.6

7.9

8.1

9.6

11.0

Inventory / Sales (days)

100

96

94

92

90

Receivables (days)

71

59

57

53

51

Payables (days)

92

141

137

125

118

Working capital cycle (ex-cash) (days)

80

14

15

20

23

Source: Company, Angel Research

11

Initiating Coverage

Safari Industries

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Safari Industries

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

12